As a business person, do you know how to manage cash flow in your small business? Well if you don’t, you’ve got to learn how to. And that’s why we are here for you.

It is a well-known fact in business that cash flow is king.

And if cash flow is king then cash flow management is a vital part of any growing business.

Simply put, you need to know how to manage cash flow in your small business.

How to Manage Cash Flow in Your Small Business

Cash Flow Defined

Before we move on to the rules on how to manage cash flow in your small business, we should get the basics out of the way first.

Let’s put down a very fundamental and simple definition of what cash flow is.

Well, simply put, cash flow refers to the movement of funds (i.e. cash) either in or out of your business.

There is positive cash flow and there is a negative cash flow.

Typically, you should be tracking your cash flow on a weekly basis.

You should also generate a monthly and quarterly cash flow report.

As a business owner, you should watch your small business cashflow like you do your blood pressure.

Types of Cashflow In Business

As it was explained earlier, there are two types of cash flow; one is positive and the other one is negative:

Positive Cashflow

Positive cash flow is when there is money coming into the business.

This influx of cash comes in through accounts receivables, sales, etc.

In other words, your business has positive cash flow when there is more money coming in than money going out.

Negative Cashflow

Negative cash flow refers to money going out.

You have a negative cash flow in your business if you have more money going out of the business than there is coming in.

Profit is Not Always Positive Cash Flow In Business

When it comes to managing the cash flow of your business, profit does not necessarily mean a positive cash flow.

Some might argue that figuring out your cash flow is as easy as looking at your profit and loss statement.

They would say that a profit is simply computed as revenue minus all the expenses that you make.

However, there are actually a lot of other factors that come into play when it comes to cash flow.

You need to factor in taxation, capital expenditure, accounts payables, your inventory, and also accounts receivables.

You need to account for all of these factors when it comes to increasing small business cashflow.

Profit and loss plus all of the other factors are the main drivers of cash in your business.

Sure, you know you made a profit but do you really know what happened to your cash?

Did you notice that your business may be bleeding out its cash reserves?

To be able to determine your cash flow status you must keep the two important tips in mind.

These tips are;

You Must Know Your Break-Even Point

The break-even point of your business is the dividing line that will tell you if you’re making money or not.

That’s where you can tell if you have a profit or not.

Will your profitability create cashflow?

It probably won’t.

Will profitability have a strong impact on your cashflow?

Well, maybe it will and maybe it won’t.

However, knowing your breaking point will help you define your goals.

You want to generate enough positive cash flow so that you can get out of your break-even point.

Find out where the sources of positive cash flow are and concentrate on those.

You should also find out where all the negative cash flow is coming from and block any leaks as fast as you can.

Account for Everything

One very important reminder that all of us entrepreneurs should remember is that you can’t control anything that you can’t measure.

If it is intangible and/or not clearly defined then you have no control of that thing.

Here are some questions that you can answer that will help you figure out the things that you should be accounting for:

- The amount of working capital in your business

- How much inventory do you have?

- How much of your cash is currently tied up in receivables?

- Also, ask how long will it take for orders to go through the process and return to you as actual cash?

- How many invoices are now currently overdue?

Cardinal Rules for Managing Cash Flow in Your Small Business

Let’s start with the main rules when it comes to cash flow management.

Sometimes all you need to do is follow some very simple protocols to get it done right.

If you follow these rules you can avoid a lot of possible cash crunches, which usually comes when you least expect it.

Hence, to successfully manage cash flow in your small business you need to;

Rule 1: Invoicing (Get It Done and Do It Right)

Invoicing is at the heart of cash flow control.

Remember that you can’t control anything that you can’t measure.

Likewise, you can’t measure your cash flow if you don’t have proper records.

That’s where good invoicing practices come in.

Here are a few good invoicing practices that you should implement:

- Get into the habit of sending invoices for payment as soon as possible.

- Make it a standard practice in your business to send invoices immediately if not on a daily basis.

- Consider asking for a deposit upfront as a kind of partial payment for products and/or services.

Remember that a product or service that has already been delivered to a client is almost as good as cash.

Well, you’re just one step away from getting cold hard cash in your hands.

That is why you should invoice your client as soon as you can.

Rule 2: To Manage Cash Flow In Your Small Business, Keep Your Books Up to Date and Of Course Accurate

Remember that invoicing is only one part of the entire documentation process that helps you keep track of your cash flow.

Every invoice you send out is a record (i.e. hard evidence) of each transaction you make.

It is a record of your revenue.

However, you need to keep track of more than just your revenue which is why you need to keep your books accurate and up to date.

Up to date records allows you to keep track of unpaid invoices.

It is suggested that your cash flow can only be as good as the level of your accounting.

Hence, make sure to improve your record-keeping, and that is how to improve cash flow.

Accurate and up to date records also give you a good idea as to the financial well-being of your business.

Rule 3: Manage Cash Flow in your Business by Simplifying Your Accounting System

A tool that you cannot understand is a tool that isn’t used optimally.

It’s like having a nice high tech car.

Sure you can drive it around as usual.

However, unless you know all of its features you can’t appreciate its full potential and take advantage of its features.

You may have purchased the latest state of the art accounting system.

But if you’re using it just like the plain old spreadsheet program that you were previously using then you’re not really making any progress.

Worst case scenario; the accounting system you have in place is so confusing you don’t exactly know what is going on.

How do you know that you have enough cash to cover or even expand your payroll?

Are you sure that you still have enough inventory?

What if you get a huge order, are you sure you have enough to cover it?

How many accounts receivables do you still have?

Are you still getting enough inflow more than your cash outflow?

You really don’t need to invest in the latest and most feature-rich accounting systems.

What you need is something that you can understand and use to track important metrics.

If you’re just starting out or if your operations are still small then opt for something simple and direct.

You can move up to a more complex and feature-rich software when your business eventually grows and you really have a need for it.

Rule 4: Don’t Be Too Nice to Your Customers

Customers have a huge impact on determining your cash flow status.

Take note, this doesn’t mean that you shouldn’t be nice to your customers at all.

Just don’t be too nice.

If you want to be able to manage cash flow in your small business, then you should take this point seriously.

If you are way too lenient with customers especially those who are always late on their payments then you’ll end up with a cash crunch.

Let’s face it.

It’s a sure-fire way to be abused and customers will take advantage of that if you allow them.

Make it a rule to be fair and direct with your customers.

Also, make it your business policy that customers pay on time for services rendered to them.

A polite but prompt invoicing practice will go a long way to help you effectively manage cash flow in your small business.

But don’t be afraid to take other collection actions as needed or as necessary.

Keep an eye on your accounts receivables and be more assertive towards accounts that have been lying cold on the accounting floor for long.

Rule 5: In Order to Manage Cash Flow In your Small Business, Establish and Grow Your Cash Reserves

Access to cash is something that any business will need.

If you can ensure that you have access to immediate cash any time then you are already one step ahead.

Having this cash reserve (or emergency fund) can make or break your business.

This is one of the ultimate ways to manage cash flow in a business.

Think of it as a cushion that you can fall back on when something unexpected comes along.

Having that emergency cash reserve allows you to confidently step up in building your business.

It’s not always easy to build a good amount of cash reserves.

But if you can pull it off, then you have just made something that will insulate you from the usual economic cycles.

Remember that finances sometimes go for a roller coaster ride.

Sometimes you have no choice but to follow the heels of banks and other lending institutions.

That is why cash flow is important for small businesses.

A good amount of cash reserves will equip you with funds that you can use in case a big opportunity comes your way.

Opportunities like huge orders or inventory discounts provided by your suppliers.

Think of it as being in a position of strength.

Not every small business can create a cash reserve.

And those who are able to do it are already one step ahead of the competition.

Rule 6: Manage Cash Flow in your Business by Keeping your Business and Personal Account Separate

Still on the subject of managing cash flow in your small business.

This is an essential rule of thumb for any entrepreneur.

It should always be a part of all types of effective cash flow management strategies.

There should be a separate accounting of your own personal cash flow and also the cash flow of your business.

This practice will help you determine the actual state of the finances of your business.

You should be able to determine how much cash your company is generating.

Furthermore, you should know how much is going out of the business, and if you are creating enough cash reserves.

Only after that should you determine if you’ll be able to pay yourself from your business.

This is an important aspect of cash flow control.

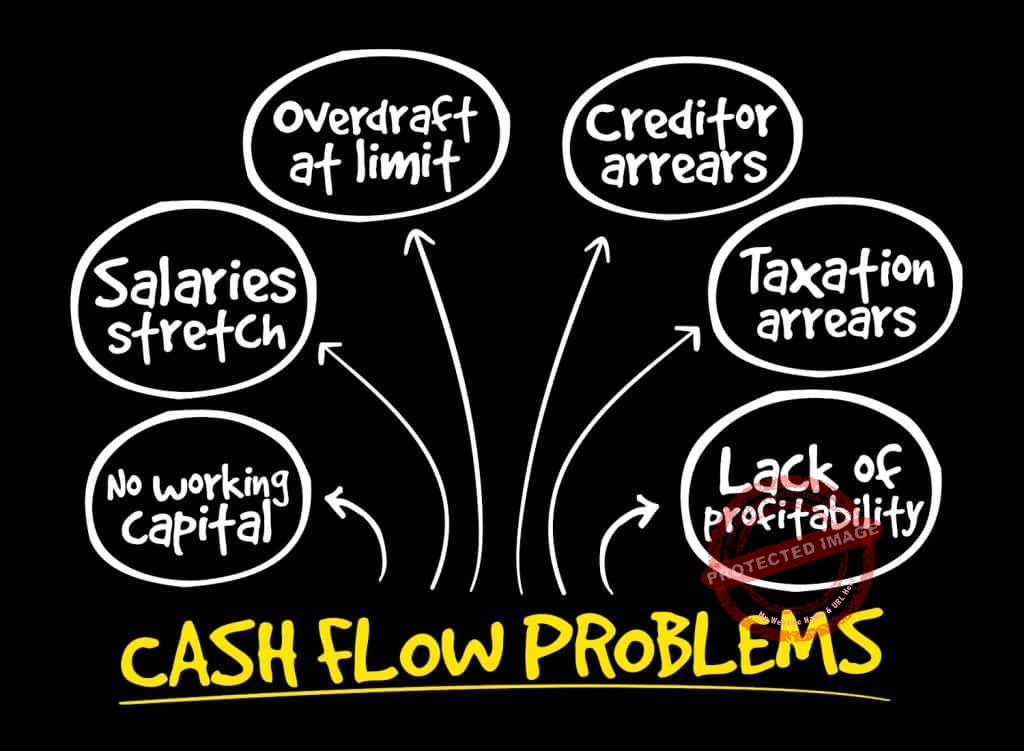

How to Fix Cash Flow Problems

Increasing small business cash flow is not that easy if you are experiencing a cash crunch.

And it happens from time to time.

You try to avoid it but there will be times when you’re just not able to generate enough cash inflow.

And then a huge order comes along.

It’s an opportunity you may lose if you don’t find enough cash to stock up on your inventory and fill that order.

What do you do?

Well here are a few ideas that might help with this and other cash flow problems.

Ways to Manage Cashflow In Business

Short-Term Financing

Short term financing refers to a line of credit that you can obtain that you can use to make emergency purchases.

This is what you will use to bridge the gap between your receivables and your payables.

Properly managing cash flow means that you should be able to fill that gap.

A good example of short term financing is the business credit cards that banks issue to medium and small enterprises.

You can use this type of credit to pay your suppliers and vendors to keep operations going until the time when you can collect money to cover for the cost.

Long Term Financing

This is what you will use in case you need to purchase large assets such as real estate or equipment.

This is actually a better alternative rather than spending your business capital.

And that is also part of smart cash flow management in business.

Using long term financing allows you to spread the payments all throughout the usable life of the asset that you purchased.

The downside, however, is that you will have to pay interest on the loan amount.

Nevertheless, the benefit of this is that you get to preserve your very own working capital.

Liquidate Any Amount of Cash That Has Been Tied Up with Business Assets

Another great way to manage cash flow in your business is to liquidate some of your assets in the business.

Look for inventory or even assets that you no longer use for business.

It can be office equipment or even office supplies.

Do you have any assets lying around that aren’t earning you money?

Then you should sell them to convert them to cash instead of allowing depreciation to take over.

They just take up space in the workplace and they are tying up capital that can be used elsewhere.

This is one of the effective cash flow management strategies that you should take advantage of.

You can get a taxable gain by selling equipment that has been owned for a longer period of time.

Equipment like that may have a book value that is equal to its estimated salvage value.

Make sure to note that when you file your taxes.

Just remember that if you sell below the book value that you will most definitely incur a loss.

If you have any kind of inventory that will not be used within the next 12 months then it would be better to sell them.

The cost to retain them might be greater than the funds that you might gain from their sale.

Be More Aggressive with Collecting Receivables

The rule of thumb here is to bill as early as you can and collect as quickly as you can.

Cash is a fluid commodity and it can slip out of your hands faster than you know it.

That is why you should make the effort to have more cash inflow going into the business more than cash flowing out.

Note that at times it is easy to lose track of an overdue account.

If you have a huge sales volume, those three to five overdue accounts will slip passed unnoticed until they are brought to your attention at a later time.

You should also make it easier for your customers to pay you.

That means you should use more than one payment method.

For instance, you should set up credit card payments, online payments, checks, cash, bank transfers, and others.

You can even leave a payment link on your invoices.

Delay Payables as Much as It Is Possible

Payables will proverbially bleed out cash.

If there is an incentive from your creditors when you pay early then you should pay as early as you can.

Maybe you can offer a discount for early payment.

However, if you can delay payables as long as you can then do it.

That allows you to keep the cash in your account so that you can use it elsewhere to generate more cash.

These are the reasons why cash flow is important for small businesses.

The tips and rules above serve as guidelines on how to effectively manage cash flow in your small business.

Do take learn from them, apply them and start experiencing the benefits of well-managed cash flow.

Also, please do check out the links on this post as they contain other informative content that could be very beneficial to you as a business owner.

Click on Buy Now For a PDF Version of This Blog Post

|