Thinking of taking over a business with an empty bank account?

This article will show you how to take over a business with no money.

Read on!!

Entrepreneurs who know how to take over a business that is already existing enjoy a better head start compared to those who start a new one from scratch.

After all, an operational business offers a lot of benefits.

These include products and/or services that are already established.

It also has trained staff who are familiar with the business.

They can help keep the business running until such time that you get a good understanding of the operations.

Now, if you think you don’t have enough money for buying a business, don’t fret.

It should not stop you from making a move.

You shouldn’t be discouraged even if big banks are now imposing stricter standards for their commercial lending activities.

Here are the steps to acquiring a business with little or no money.

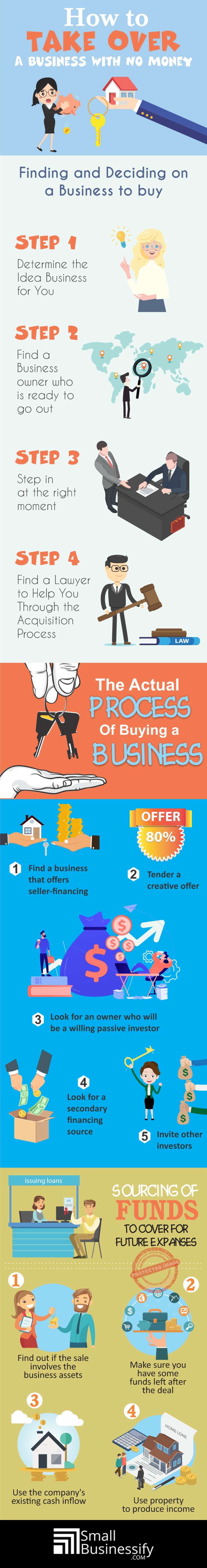

Finding And Deciding On A Business To Buy

Step 1 – Determine The Ideal Business For You

Before starting to find a business to buy, you need to decide on the kind of business that you’d like to own.

“What type of business do I want to run?”

This is one of the most important questions to ask when buying a business.

This is true even if your goal is to flip it for a profit later.

You have to run the company and give it some time to grow.

This will increase its value when the time to sell comes.

It is important that you want to get involved in this kind of business.

Knowing what you want will make the entire process easier.

This way, you can save time as well as money in finding and identifying the business you will buy.

Step 2 – Find A Business Owner Who Is Ready And Willing To Get Out

Check out businesses in your locality, as well as their owners.

Find the ones that are ripe for the taking.

These are often businesses whose owners are preparing for retirement or ready to start a better business opportunity.

Your best bet would be businesses with retiring owners.

This is because they would have more reasons to sell their business fast.

The problem is, finding these businesses is not a walk in the park.

Follow these tips for buying a business with a retiring owner.

- Talk to accountants and lawyers working with businesses in the area.

- Talk to the owners of the local businesses themselves. Even if they do not want to sell, they may refer you to one who does.

- Check out local publications. Find business owners who are approaching the age of retirement.

Step 3 – Step In At The Right Moment

One important item that should be in your taking-over-a-business checklist should be, ‘to enter at the right moment’.

This will allow you to make a timely offer, and secure a good deal.

The timing must not only be right for you but for the owner of the business, as well.

Good timing is, as mentioned earlier, a period when the business owner is ready to retire.

Another good time to come in is during an economic downturn or recession.

At this time, the owner may be looking for a fast exit to support his financial stability.

Grab the opportunity.

This is a good method on how to buy a business with no money.

As a buyer, this can pose risks for you.

But, you may get a betting financing from the seller.

This way, you can work on growing the business fast towards the end of the economic downturn.

Step 4 – Find A Lawyer

The process of buying a business without money is known as a ‘leveraged buyout’.

To go through the process, you will need the services of a competent business lawyer.

This way, you can be sure that the deal will have the proper structure.

Make sure that you hire a lawyer who specializes and has experience in business sales.

A general purpose attorney may not do a good job for you.

This is because a lot of things can go wrong in a business deal.

This is more evident in transactions handled by an inexperienced lawyer or one who does not specialize in business dealings.

The Actual Process Of Buying A Business

Step 5 – Find A Business On The Selling Block That Offers Seller-financing

There are sellers who are willing to extend a loan to buyers.

This means the business owner is offering a loan to prospective buyers of their business.

This is a good item to include in your taking-over-a-business checklist.

Find a business on the selling block that comes with a seller-financing offer.

This will give you a good head start on how to take over a business without having to spend a lot of money.

It is worth mentioning that not too many business owners may be willing to loan you the entire selling price. So, you need to come up with some money to make the down payment.

The good thing is, you can borrow the down payment money from other sources.

This will allow you to buy the company without shelling out your own funds.

Let us assume you find a business owner who is willing to give you a loan to buy his business.

This often translates into two things.

One: The business owner has faith in his business.

Two: He believes that you have the ability to manage his business well.

This is a big boost in your efforts to succeed in your new venture.

But, this can also mean that the business is in a limited market.

So, there are only a handful of buyers.

As a result, the business owner may be facing the dilemma of liquidating fast.

And, it is often at a price that carries a significant discount.

Step 6 – Tender A Creative Offer

If the business owner is not so sure about offering 100% financing, you may want to make an attractive offer.

Try to make your offer to buy the business in an attractive package that the seller will find hard to ignore.

Your offer may include bigger payments for a set period of time.

It may also come with a more preferred interest rate.

You can even offer your services for free.

For instance, you may say that you’ll be willing to work for a given number of months – without salary.

All the profits will then go to the seller.

This is known as ‘building sweat equity’.

Step 7 – Look For An Owner Who Will Be A Willing Passive Investor

There are business owners who have been running their own company for many years – some even for decades!

Sure, they would love to retire soon and enjoy the fruits of their labor.

But, they would still like to have some extra income to sustain them in their retirement years.

Talk to a business owner in this situation.

Try to convince him to sell his business to you.

To make your offer sweeter, tell him that if he allows you to run his business, he will get a certain percentage of the profits in return.

In this scenario, you may still have to produce some money of your own.

As mentioned earlier, you can get this from other sources.

Also, you will need to pay the seller a specific percentage of your revenues for a given period of time in the future.

This is like owner-financing. The difference is that the payments to the seller will depend on the business’ success. The good thing is, you will not incur any debts this way.

Step 8 – If Necessary, Look For A Secondary Financing Source

By now, you know that it will be very difficult to find a business owner willing to finance your purchase 100%.

This is why you may need to find a secondary financing source.

One of your options is to apply for a loan from a bank.

But, the process of obtaining bank loans is often long and complicated.

This is because banks do not want to take part in deals that are 100% financed.

In most cases, you might consider getting an unsecured personal loan from a lending company.

Step 9 – Invite Other Investors

Now, you are reading this article because you want to take over a business, but, you have no money to finance your purchase.

Another thing you can do is to bring in other investors who can help you with the financing.

These partners can put in the money you need in exchange for part of the future profits of the business.

These investors can also act as silent partners. Their only job is to contribute funds. They will not have active participation or responsibilities in the business.

Another option on how to raise money for your business is to issue preferred stocks to different investors.

These may include your family and friends.

You also have the option of getting unsecured debt from them.

Sourcing Of Funds To Cover For Future Expenses

Step 10 – Find Out If The Sale Involves The Business Itself Or The Business’ Assets

There is a difference between the two.

This is in the assumption of the debts due from the business.

If you only bought the business’ assets, you do not assume liability for its debts.

But, if you bought the entire business, you need to have a provision for the repayment of the existing loans of the business.

This will have an impact on your decisions.

It will affect your schedule of payments to the seller, as well as the value of the business you are buying.

Step 11 – Structure The Deal In A Way That You Will Have Some Funds Left

You may have succeeded in securing a deal with the owner and getting secondary financing. Now, the thing is, you don’t want to have an empty money bag once the sale is consumed.

After all, you still need to cover a lot of expenses.

These include attorneys’ fees, working capital, as well as funds for your capital budget.

One of the most important questions to ask when buying a business from a business owner is, “How much owner financing he can extend?”

The answer should be clear to you before you make your offer.

This will help make sure that you will have some leftover funds once the parties agree to a deal.

Step 12 – Determine If You Need To Secure Extra Funds For Your Working Capital

You know you have done a great job of buying a business without spending if you have been able to buy a company, for example, worth $100,000 using 100% borrowed funds.

Congratulations!

But, the story doesn’t end there.

You must have enough working capital to sustain your business operations.

You need to cover expenses such as salaries, rent, and utilities, among others.

So, you need to set aside some working capital.

You can get the funds from the same sources where you got the money to buy the business.

If possible, you can also use the business’ existing assets and income to generate the money you need.

Step 13 – Use The Company’s Existing Cash Inflow

You can divert the cash flow to provide your working capital.

This way, you can avoid borrowing from other sources.

But, you need to make sure that your cash flow can sustain your business operations in the future.

This is where proper cash flow projection comes in.

If you are not comfortable or experienced in making cash flow projections, you can seek professional help for that purpose.

You can also hire a financial professional to prepare the projections for you.

Step 14 – Use The Company’s Existing Assets To Generate Revenues

One of the best tips for buying a business is to use income-generating business assets.

Try finding opportunities to re-purpose or sell your existing equipment, machinery, and other business assets.

This will help you make extra income without having to invest your own money.

For instance, you can sell vehicles and equipment that you no longer need.

Of course, the income you can generate will depend on the type of business you are running.

Some businesses own more physical assets than others. So, you need to assess all the assets you have and determine their market value.

Bear in mind that you can only do this if these assets are not tied up as security to the former owner or seller.

Step 15 – Get Receivable Loans To Finance Your Business

One way is to use the process of ‘factoring’.

It involves selling your accounts receivable to a third party at a discount.

This will allow you to get the funds you need fast.

On the other hand, accounts receivable financing lets you get loans against the value of your receivables.

You must be able to make regular repayments to the lender.

Otherwise, you will lose the rights to collect your receivables.

A factoring deal often sees the third party paying your business 75 – 80% of the value of your AR [accounts receivable] outright.

This way, you will have immediate funds to use for your operations.

The rest goes to the third party.

If you think you need factoring services, you can request your bank to refer you to a third party factoring service provider.

Note that you should only resort to factoring as a last resort as it is not a cheap way to get working capital.

Step 16 – Use Property To Produce Income

One of the sound steps to acquiring a business is finding a business owner who owns a business-related real estate property.

This way, you may succeed in structuring a deal that will include a lease to the property with a buy option.

Or, you may find a way to refinance the property for cash by securing a loan from another source.

Step 17 – Think About Refinancing Or Taking Out Additional Loans

If you know you have done everything to no avail, you can always apply for loans to cover the cost of your working capital.

A good way to do this is to use your inventory to secure the loans.

An inventory loan will give you the funds you need to buy your merchandise.

The lender will then hold your inventory as loan collateral.

The problem is, many banks and lenders are not too open to extending inventory loans.

This is because the lender may find it difficult to sell your inventory when the need arises.

Another option is to apply for a merchant cash advance.

This is possible if the business has a lot of credit card sales.

This way, your lenders will provide you with cash up front.

In return, they will take a portion of the proceeds from your credit card sales.

This will be for a specific period of time.

How To Take Over A Business With No Money Infographic

Finally…

The process of how to buy a business with no money is not a piece of cake. You need to put in some time and effort to succeed. But, the rewards are great.

Follow the steps and tips provided in this article.

This will give you a better chance of running the business that suits you well in the end.

Do you know any other steps one can take to purchase a business without money?

Please share with us!

Click on Buy Now For a PDF Version of This Blog Post

|