Different types of business organizations exist in the business world today. The success of any business depends on its structure. The level of ownership you as an individual or a group has over a company drives your organization.

The basic types of business organizations include sole proprietorship, partnership, and corporation.

There are also other modified forms, which combine the principles of a partnership and a corporation.

Examples are the Limited Liability Company (LLC), “S” corporation, and Limited Liability Partnership (LLP).

Aside from ownership, several considerations determine how suitable your organizational form is to an enterprise.

You should consider your personal, financial, legal, and tax concerns, among others.

We will discuss the generalities and the pros and cons of each type of business organization.

4 Types of Business Organizations

1. Types of Business Organizations – Sole Proprietorship

Small-scale or fresh entrepreneurs usually start out their businesses as sole proprietors.

A sole proprietorship is the simplest organizational form because it only consists of a single person engaging in business.

Among all forms of ownership, it is the simplest and cheapest to set-up.

Although you take all the profits, you also face unlimited liability for all the debts of your business.

Your creditors may go after your personal assets if the business is unable to pay them.

You, the proprietor can report the income or loss from the business on your personal income tax return.

This report includes all other personal income, expenses, and assets.

This is because a single proprietorship is not a legal entity.

As a result, You should sign all contracts, receipts, and checks written under your name.

Considering all the types of business organizations, this one is very intertwined with its owner, compared to the rest.

To start out, you will only need to register your name and secure local licenses.

You do not need a formal event to form a sole proprietorship.

It is simply born out of your business activity.

Nevertheless, a sole proprietorship has the potential to grow into a more complex business form as the business matures.

Pros of Sole Proprietorship

-The creation of a sole proprietorship can begin instantly.

Announcing your business can be as simple as a social media shout out or e-mail blast to friends.

-All business-related decisions are solely up to you.

You can do away with the voting, meetings, and all other ceremony associated with more complex business organizations.

-It is typical for sole proprietorships to have low start-up costs and low operational overhead.

–In a sole proprietorship, the owner can take all the profits of the business after paying tax on them.

-Most sole proprietorships are relatively small business entities.

So, the government subjects them to fewer regulations.

–There’s no need to pay corporate income taxes since you can freely mix business and personal assets.

You will declare any income that you realize on your individual income tax return.

Cons of Sole Proprietorship

–You are exposed to unlimited liability.

All the business’ debts are under your name.

–If you encounter financial trouble, creditors may file a lawsuit against you.

Issues like this may cause you to pay with personal money. In some cases, this can drive one to bankruptcy.

–You are responsible for all the actions, including business-related accidents, of the people under your employ.

If someone is seriously hurt or worse, you will have to pay for all of the damages using personal assets.

–Raising the capital to start a sole proprietorship can be challenging.

Most people rely on personal savings or personal loans.

-A sole proprietor can’t increase his/her capital by selling an interest in the company.

This would change the business organization to a more complex form.

-A sole proprietorship does not retain its value and has a limited life.

Its existence is dependent on your capacity and health.

If you die or become unable to run the business for any reason, it dies as well.

2. Types of Business Organizations – Partnership

When two or more individuals own and operate a business, they can form a partnership.

A good example of large-scale partnerships are legal and accounting firms that have dozens of partners involved in running the company.

Partnerships exist in two common varieties: General partnerships and Limited partnerships.

The basic difference between the two revolves around your degree of personal liability and management control.

In a general partnership, all partners have a say on how you manage your business.

At the same time, you all have unlimited liability for the partnership’s debts and other obligations.

Any of the general partners can act on behalf of the partnership.

So, you could take out loans, and make decisions that could impact and be binding to all the other partners.

Meanwhile, limited partnerships are a mix of general partners and limited partners.

As mentioned earlier, your general partners own and operate the business.

They take responsibility for all the liabilities of the partnership.

On the other hand, your limited partners are merely passive investors.

Limited partners have reduced control in the management of your company.

So, their exposure to the debts of the partnership is also limited to the amount of their contribution to the partnership.

Essentially, people form partnerships to join resources and arrive at a bigger capital.

You share the profits of the business accordingly among you.

The partnership does not pay a corporate tax on its income.

Instead, the partnership’s income tax is shared among you.

It will be paid together with your individual income taxes.

Starting a partnership requires administrative involvement.

It is more expensive because you need to involve legal and accounting services.

Here having a partnership agreement is crucial towards maintaining a peaceful business.

The partnership agreement should address particular issues.

These include defining your ownership shares, voting rights, partnership purchase price, and payment schedules.

Pros of Partnership

–You can usually merge personal resources together.

So, there is access to greater amounts of capital than that of a sole proprietorship.

–Team-effort among two or more individuals enhances value.

You and your partners are able to combine your strengths and expertise.

–With an agreement in place, partnerships are relatively easier to form than a corporation.

Moreover, in comparison, the government subjects them to fewer regulations.

– Among the types of business organizations, similar to the sole proprietorship, your partnership is also exempted from paying corporate income taxes.

–Your partnership declares its income by filing a partnership income tax return.

However, it pays no corporate taxes.

–Rather, you, the individual partners declare your respective share of the income in your personal income tax return.

Then go ahead to pay taxes at your individual income tax rate.

Cons of Partnership

–Similar to sole proprietors, general partners are subjected to unlimited liability.

Hence, in entering a partnership, they also put their personal assets at risk.

-Like any organization, there is a high chance of disputes and conflicts between partners.

Such would potentially jeopardize your partnership.

This is why it is important that a clear-cut partnership agreement is in place from the start.

-Your partnership may dissolve upon the death or incapacity of a partner.

In this regard, it has a limited life.

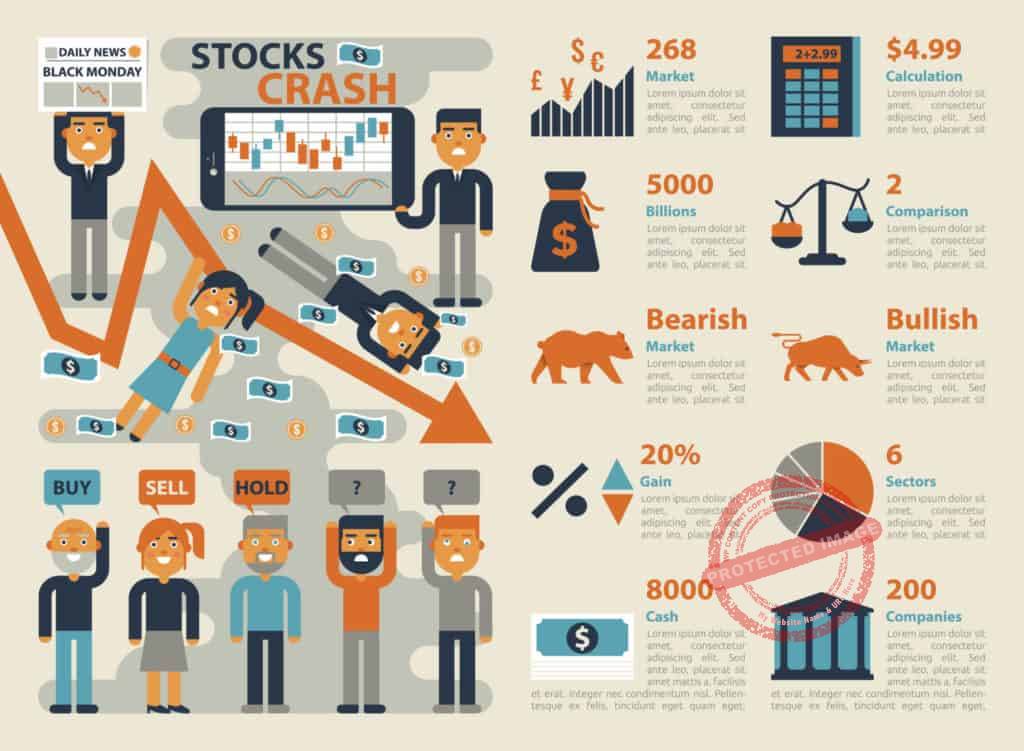

3. Types of Business Organizations – Corporation

The most dominant form, among the types of business organizations in the global economy, are Corporations.

A corporation has a legal identity, which is separate from its owners.

The state gives your corporation protection.

Your corporation’s legal rights are similar to that of an individual, except for the right to vote and certain other limitations.

Here, your business is incorporated by filing its articles of incorporation with the appropriate government agency.

Generally, only one corporation can exist under a given name in a state or country.

There are also administrative and filing fees required in incorporating your business.

The charges vary among the governing bodies.

As the owners of the corporation, you are known as its shareholders or stockholders.

You put in money or other personal assets into the company in exchange for shares in the stock.

However, only a handful of stockholders control the activities of the corporation.

You elect a board of directors from among you.

The board is responsible for guiding corporate affairs.

Board of Directors

These directors also elect or appoint officers such as a president, vice-presidents, and other associates.

The appointed officers conduct the simple activities of the corporate business.

Corporate bylaws govern the degree of power and authority your shareholders, directors, and officers possess.

Investors in your corporation have limited liability on its obligations and debts.

Creditors are only allowed to go after the corporation’s assets for payments.

In the event that your corporation is not doing well or is held liable for damages, the most you can lose is your investment in the stock.

Your corporation files its own tax return and pays for its income tax.

When the corporation employs shareholders, it considers their salaries as deductibles.

Corporations also enjoy certain tax benefits such as the deductibility of health insurance premiums.

In cases when your corporation distributes its earnings in the form of dividends, the individuals receiving the earnings must pay the taxes for those dividends.

Even if the corporation has already paid the tax for its earnings.

Dividends do not reduce the corporation’s tax liability.

For a small corporation, there needs to be a buy-sell agreement if a shareholder dies or wants to sell his/her stock.

This agreement also sets the fair price of the shares in question.

Large corporations that sell their shares to many individuals may need to register with a regulatory body such as the Securities and Exchange Commission.

A properly formed, capitalized and operated corporation increases its chances of profit-making as well as limits the liability of its shareholders.

Pros of Corporation

–Raising capital is flexible through the selling of stock.

In the same way, transferring ownership is easier.

Ownership can be transferred through the sale of stocks.

–Limited liability is the primary advantage of organizing as a corporation.

The value of your shareholder’s stock in the business limits his/her liability.

This is regardless of the total amount of debt your corporation has.

-Your corporation has an unlimited commercial life because it exists as a legal entity on its own.

Ownership is smooth through the sale of stock.

Cons of Corporation

–Because your corporation enjoys legal rights, governmental agencies subject it to severe regulation and monitoring.

Moreover, compliance with these regulations can be costly to your business.

-With the complications involved, managing a corporation entails higher organizational and operational costs.

–Apart from the continual expenses, corporations also need to pay the charges for filing its articles of incorporation with the appropriate state authorities.

–Double taxation has a good chance of happening because your corporation must pay taxes on its income and your shareholders also pay a separate tax on any dividends they receive from your corporation.

Business owners sometimes solve this by increasing their own salaries to raise the deductibles in the corporation’s tax return.

Businesses have evolved over time.

Some are organized differently from the traditional forms or types of business organizations discussed above.

Tax considerations and liability issues drive the evolution of business organizations.

These emerging forms are fairly new, which makes management and regulation a bit challenging.

4. Types of Business Organizations – Limited Liability Company

The Limited Liability Company (LLC) is a joint business form that combines the features of both a partnership and a corporation.

There are varying types of Limited Liability Companies depending on what country you are based in.

Generally, among the types of business organizations, this one seeks to enjoy the tax advantages of a partnership and the limited liability of investors in a corporation.

You and your partners distribute the income from your business among you.

You will declare these shares in your personal income tax returns and pay for your individual tax rates.

This scenario only happens if the state recognizes your Limited Liability entity as a partnership.

Otherwise, corporate taxes will apply.

You and your partners in a Limited Liability entity technically assume complete liability for all the obligations and loans of the business.

However, the rules of the Limited Liability entity can note that an individual is not responsible for the firm’s debt.

Such will be in a case where he/she did not secure them personally by putting personal assets on the line.

Limited Liability Entities have different operational styles.

All of its members can manage these operations.

They could also have centralized management run only by a few, guided by the firm’s operating agreement.

A Limited Liability Company can offer company stock in several different classes with different rights.

There is an unlimited number of participants in a Limited Liability Company.

They could be individuals, partnerships and corporations.

However, your LLC can’t transfer shares without limits.

As an LLC owner, you should pass the transferability restriction test before any ownership interest is exchanged.

Pros of Limited Liability Company

–You can protect your personal assets from potential liabilities like unpaid business debts, vendor disputes, and damages.

Nevertheless, when you are entangled in the following circumstances, you may lose this limited liability:

-Taking part in phony deals under the name of the business;

-Failing to meet the LLC requirements such as holding regular meetings and keeping minutes;

-Failing to separate your business and personal assets;

-Using your personal savings and personal loans in funding the business; and

-Insufficiently building up capital at the start of the business.

Your LLC can continue to exist as long as its members or officers keep it on the good side of the governing bodies.

–Unlike other business structures, you can have any number of members.

Single-member LLCs are not uncommon and can even belong to a multi-layered LLC.

This method, among the types of business organizations, is popular in industries like real estate, pharmaceutical, and branded retail products.

Types of Business Organizations Infographic

Cons of Limited Liability Company

–There are filing fees needed to start an LLC.

Moreover, you will pay annual filing fees afterward to keep your LLC current.

The relevant government agency collects these fees.

–Because of its mixed nature, the process of filing tax returns becomes more difficult.

–Members can take money from the LLC in the form of draws.

The draws function like advances in profit-sharing.

–Partners tend to take draws from the company that is not directly proportional to their respective ownership shares.

But as a result, their taxes might not correspond to their actual drawings from the business.

–Limited Liability Companies can’t issue shares, making it difficult to raise capital for your business.

An outside investor needs to buy-in as a member to gain a hold in your LLC.

Other mixed types of business organizations include the “S” Corporation and Limited Liability Partnership.

Internationally, the taxation and regulations for the different types of business organizations vary.

It is important therefore to consult with an accountant or lawyer to determine what form of organization best fits your business.

Click on Buy Now For a PDF Version of This Blog Post

|