Are you in the process of building your business? Do you want to know why a budget is important for a business? Let’s find out why.

The importance of budget planning can’t be stressed enough.

Whether you’re intent on developing a small-scale or corporate-sized company, this is one thing you must prepare for.

If you’re new to business budgeting, don’t fret.

You can start off with something like a small business spreadsheet for income and expenses.

Of course, you must have a strong concept in mind for your trade.

But you need realistic, not to mention detailed budget projections.

Without which, you’ll miss out on an essential tool that can help you guide your business to succeed.

Without these, it will be quite challenging to operate properly and generate desirable profits.

Most times, the absence of such can lead to you going beyond your means even before the business starts rolling.

Without set parameters for spending, it’ll be difficult to handle various business tasks no matter how simple they may be.

Budgets vary depending on the size and requirements of a business.

However, there are standard inclusions that form your initial set of business budget categories.

These include your initial capital, estimates for both fixed and recurring expenditures.

Also included, are long and short-term investments, and of course, your expected revenue projections.

Your business proposal budget is not only for the early process (the period you’re building the company from scratch).

It’s actually something that you’ll continuously reference and adjust as you proceed with your daily operations.

It’s something that you’ll rely on to measure how well your company is performing month in and month out.

Why Is Budgeting Essential?

There are plenty of reasons that justify why a budget is important for a business of any kind.

Here’s a more detailed explanation of the primary reasons that should convince you regarding the importance of budget setting.

Budgeting Helps You Plan

A business proposal budget is essential because it’ll serve as one of your main tools for planning the business.

For most business owners, it’s part of the framework that ensures a business can and will start.

It’s ideal that you develop a yearly business budget at first then adjust it as you progress with the project.

Your current financial situation will be considered here.

Other factors as well will be taken into account to ensure the best initial projection.

You’ll also be taking a look at past trends.

In doing so, you will be able to create more realistic forecasts for the year ahead.

Here, your budget projections will include a more detailed view of your existing assets and potential investments.

Also your expectations for revenue, and other elements that you might be spending on later.

A budget is important for a business because you’ll know how much you’ll spend on each phase of the business journey.

You’ll also have something to reference to see if your projected revenues are enough to shoulder these potential obligations.

This will then help you adjust your plans to ensure that revenues exceed expenses as you operate.

You can start by using something as simple as a small business spreadsheet for income and expenses.

This will be enough to help you with the former and also assist you in goal-setting and prioritizing tasks.

Your budget will show you the source of funds.

Match these sources with the different things you plan on executing.

Identify whether you need to generate more income or as part of your overall operating strategies.

You can then compare the potential income with the projected expense and adjust as necessary.

As you figure out which strategies have the potential of boosting sales, you can then take note of these and mark them as high-priority components in your business plan.

Gradually, you will gain a better understanding of these different cause-and-effect relationships.

You can then decide on which things to prioritize and which to possibly leave on the backburner; or reconsider.

This is one of the reasons why a budget is important for a business.

You need to have an understanding of business budget categories.

This will ensure that you end up with an organized budget plan.

In making a budget plan for a company, it’s not just about listing things down.

You need to break down revenue and expense components into some level of detail.

The more detailed it is, the easier it’ll be for you to make better-informed decisions based on your budget plan.

Apart from breaking things down by category, you should also consider breaking components down by department.

This will really depend on the size of your business.

Your master plan will consist of all of these broken down categorical entries.

If your business is projected to have peak seasons that generate most of your annual income, having a budget plan helps you plan ahead of time.

Enabling you to capitalize on these peak months in terms of revenue generation.

It also helps you redistribute your expense budget so as not to experience difficulties during months when sales are low.

This applies to short and long-term expenditures.

While short-term expenses are easier to manage, long-term investments require more attention.

With a budget, you can schedule savings over several months for a large expense that you anticipate to make later.

Budgeting Helps You With Financing

If your business is of a larger scale, a basic daily expense sheet for small business operations may not cut it.

Most especially if you have to report to lenders as well as present to viable investors.

For this, you don’t just want to show them you know how to make a budget plan for a company.

You also want them to know that your company is one that they should have faith and consider investing in.

The lenders especially won’t be impressed with reports created using basic budget templates for business.

They have the tendency to thoroughly investigate people’s business records.

So, provide what will make them confident in lending you the funds required.

A properly-done and well-presented yearly business budget will show them that you have strong and reliable business practices.

Having one will reduce potential red flags that may turn them off. This emphasizes why a budget is important for a business.

Have the initiative to research trends for your industry.

Study past and present performances of your potential competition.

Then apply your learnings in the budget plan that you create.

By showing lenders that you understand the workings of such a business, they’ll have more faith in what you offer.

Remember, creating a budget that will lead to favorable financing decisions is your best bet.

Budgeting Helps You With Staffing

Even the smallest businesses may need a few employees here and there.

Having a working budget helps the owner determine how many people need to be employed for the tasks at hand.

When it comes to staffing, it’s all about balancing manpower with daily responsibilities but also considering income-generating abilities.

Even if you operate a small store, you might require, say, the services of an in-house accountant because you’re not one to effectively handle the books.

When you look at your budget, you might see that you’re not in the position to hire someone full-time.

So you can make that informed decision and save yourself money and headaches moving forward.

If you’re operating a small business at home, you might have a budgeting home business expense spreadsheet that’ll tell you it’s better to get a part-time marketing manager.

As previously mentioned, a budget plan helps you plan and prioritize expenses by giving a clear picture of your finances.

Giving you one more reason why a budget is important for a business.

Budgeting Helps You With Evaluation

You can use budgeting to evaluate your company’s performance over time.

Within a certain fiscal year, you can ascertain whether or not you’re profitable.

You can also pinpoint areas that can be developed upon.

You can also make better decisions when you start adjusting your operational protocols.

When budgeting for a small business, it’s not just about figuring out where to put and where to source money.

It’ll also involve the effective tracking of actual revenues and expenses.

As well as comparing these figures with what has been projected.

Why do you need to do this?

So that you’ll know if your company is sticking to the overall business plan.

Why have a plan if you won’t follow it, right?

With a budget, you’ll have the means to determine windows of opportunity and problem spots.

Here’s an example of a budget sheet assessment.

First quarter sales are lower than expected so you need to find a way to balance out anticipated expenses for the period to remain profitable.

Your budget report will help you figure out how to do this effectively as you’ll know where to cut costs.

You might also encounter months where sales are way better than what has been projected.

In this case, you’ll have a trend that you can track for future projections.

Again, you’ll be able to have a reliable reference with an efficiently-maintained budget and performance record.

Another reason why a budget is important for a business.

This information also helps you determine whether or not your supply of said product should be increased and when supplies should enter.

With the budget in hand, you’ll know if this is feasible.

You’ll also know if hiring more people to handle the additional supplies will be possible.

Creating a Business Budget

Now you know why a budget is important for a business you need to start improving your knowledge when it comes to preparing these budgets.

There are different ways to go about it depending on the scale of your business.

There’s more to this than just knowing how to keep track of business expenses spreadsheet files.

At first, you can choose to use basic spreadsheets if your operations aren’t that massive. Then you should consider using software or tools that’ll enable automation and help you manage large operations if required.

Familiarize yourself with how budgets work.

Budgets will tell you a lot about your financial situation and the company’s performance.

Understanding each figure will help you adjust current and future projections so that they match your business objectives better.

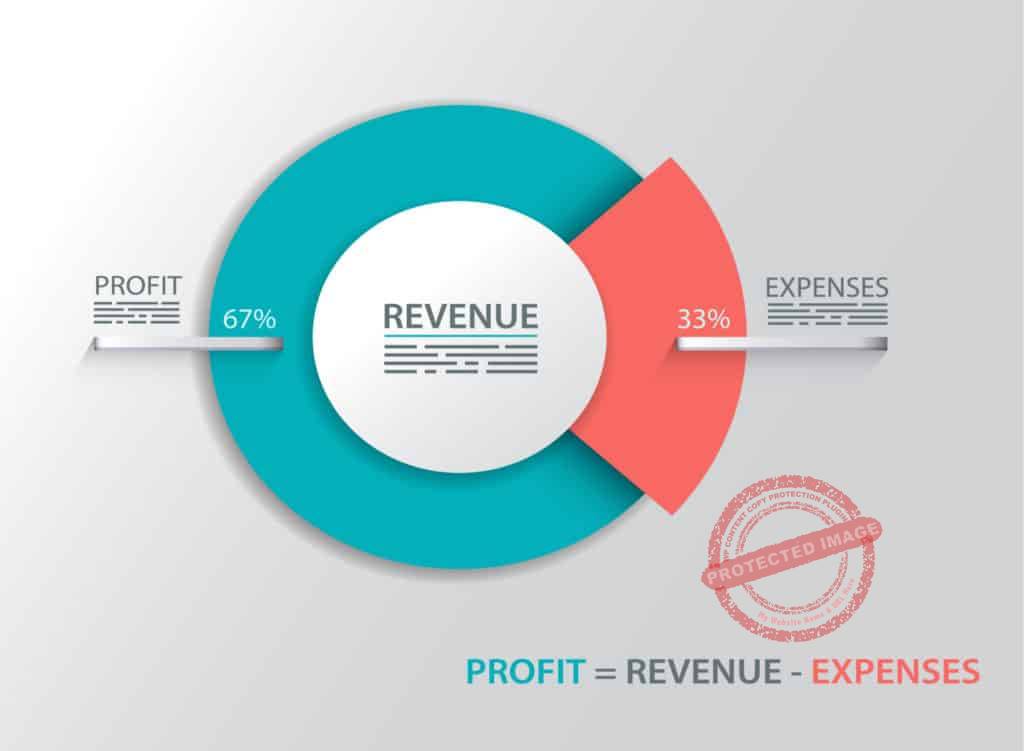

A balanced budget means that revenues offset your expenses.

As much as possible, you want a surplus situation wherein your revenues are larger than your expenses.

This is one more reason why a budget is important for a business

You want to minimize deficits as the objective is to become as profitable as possible.

You also have to familiarize yourself with the different components of the budget.

For starters, you should understand sales, costs, and profits. Sales pertain to the money your business brings in from all viable sources.

Costs cover your expenditures, fixed and recurring.

Then profits make up the difference between these two components.

You also have to learn all about proper forecasting.

The key to a reliable budget is achieving a reasonable forecast for both revenue and expenses.

To do this, you should start with your current situation or position.

For example, if you’re a business owner who has some experience, forecast your revenue and expenses based on past events.

Examining trends is essential in this case as they are excellent starting points for your working budget.

As things change during the fiscal year, that’s when you start making any necessary adjustment.

If you don’t have enough business experience, research on the past activities by your competitors or look at the industry in general.

Use the information that you gather, estimate potential sales, expenditures, and so on and so forth.

These are forecasts which means that they are not a sure thing.

They give you a viable picture of how your fiscal year may go but don’t set everything in stone.

When you run your forecasts, best practice dictates that you be as conservative as possible.

Always work with the low end of the spectrum when it comes to potential sales and income generation.

This is how you make your forecasts reasonable.

Finally,

Now that you have an understanding of budget components and learned all about why a budget is important for a business, hopefully, you’ll develop the initiative to work on your own business budgets moving forward.

Even if you’ll have a professional to do the forecasting for you, it’s still ideal that you understand the process.

This’ll ensure that you generate the kind of business budgets that will truly be dependable.

The kinds that will serve as useful assets for your business and success.

You can find budget templates on the Internet.

When it comes to budgets, there really is no reason not to try tackling it on your own.

There are plenty of useful resources that can help you every step of the way.

Moving forward, if you find the need for such, you can invest in professional software that can be applied to your business.

This’ll make the process easier and you can share it amongst multiple personnel in your company.

Click on Buy Now For a PDF Version of This Blog Post

|